Savings Plans

Regular Savings

Making it easy to save. Open this account with $100 and receive a variable rate of interest calculated on a daily available balance. Two tier levels available.

- No minimum deposit needed to open for minors

- Interest compounded and credited quarterly.

- Direct Deposit into account at no charge

- Set up automatic payments or transfers from account.

- Rate levels are:

- Up to $5,000

- $ 5,000.01 -over

Kasasa Saver

Kasasa Saver® is available to you only when you have a Kasasa Cash® or Kasasa Cash Back® checking account. When you earn cash rewards in your Kasasa® checking, those earnings transfer into your Kasasa Saver.

Learn more about Kasasa Saver.®

- Free account that builds your savings effortlessly

- Links to free Kasasa Cash or Kasasa Cash Back checking

- Automatic transfers of Kasasa Cash or Kasasa Cash Back earnings

- No minimum balance to earn rewards

- No monthly service fee

- $50 minimum deposit to open

Bright Future

For parents and others wishing to assure a Bright Future for their children. This account offers an easy way to set aside regular amounts and watch it grow to meet their educational or other goals.

- Account offers a preferred rate with two rate levels:

- Up to $5,000

- $ 5,000.01 or more

- Can set up regular automatic deposits into the account

- Low opening deposit of just $25

- No maintenance fee

- Custodial ownership

- Quarterly statement

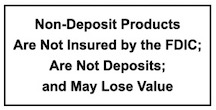

- Can easily transfer to your choice of Certificates of Deposit or investment products

- Can remain in account until age 21

Money Market Plus

For smart investors who want liquidity of their money. Offers market-based interest rates without the concern of a time-deposit and early withdrawal penalties. Open with just $2500.

- This account has five rate levels. Interest is paid on the daily balance, so as your balance grows so does your rate of earnings

- Rate levels are:

- Up to $5,000

- $ 5,000.01 -$ 10,000

- $10,000.01 – $25,000

- $25,000.01 – $50,000

- $50,000.01 +

- No monthly fee with a $2,500 daily balance or $10 per month if balance falls below $2,500 any day of the month

- Receive a monthly statement showing activity and interest credited

- Receive free checks to draw against the account when you choose

Health Savings Account

A Health Savings Account (HSA) is a tax-free interest bearing account that can be used to pay for medical expenses. To qualify, the individual must have a high-deductible health insurance plan.

Benefits:

- Annual contributions into an interest-bearing checking account are tax-deductible. Contributions can be made all at once or throughout the year

- Interest is earned tax-free

Features:

- Annual contribution limits may vary for an individual and family contributions. Be sure to review the current year’s contribution limits.

- Contributions can be made annually. You have up until April 15th or your tax-filing deadline to contribute for the prior year.

- If you’re 55 or older, you may be able contribute an extra $1,000 depending upon current year rules

- Write checks to withdraw money for medical expenses throughout the year. Amounts distributed are not taxable provided they are used for medical expenses

- Or, you can pay your medical expenses out-of-pocket and let the HSA balance accumulate tax-free. There are no withdrawal requirements

- You select primary and secondary beneficiaries who will receive the HSA in the event of your death

- A minimum deposit of $100 is required to open the account. If the balance falls below $100, there is a $3 fee for that month

Bluff View Bank accounts are free with e-statements. If you choose to receive a paper statement, a monthly service charge may apply to your account. Contact us for complete details.